Corporate compliance in Paraguay plays an important role in helping clients manage and mitigate business compliance risks. In this article, we discuss the importance of corporate secretarial services for expanding your business in Paraguay, and outline the crucial competencies to look for in a provider. The country is increasingly attractive for foreign investors, with a generous tax system. However, compliance is taken seriously, so you will need to make sure that you stay on the right side of the law.

Key Takeaways On Corporate Legal Compliance in Paraguay

| Is a physical address in Paraguay necessary for doing business? | Yes, a Registered Office Address or local Fiscal Address is required for all entities in Paraguay for the receipt of legal correspondence and government visits. |

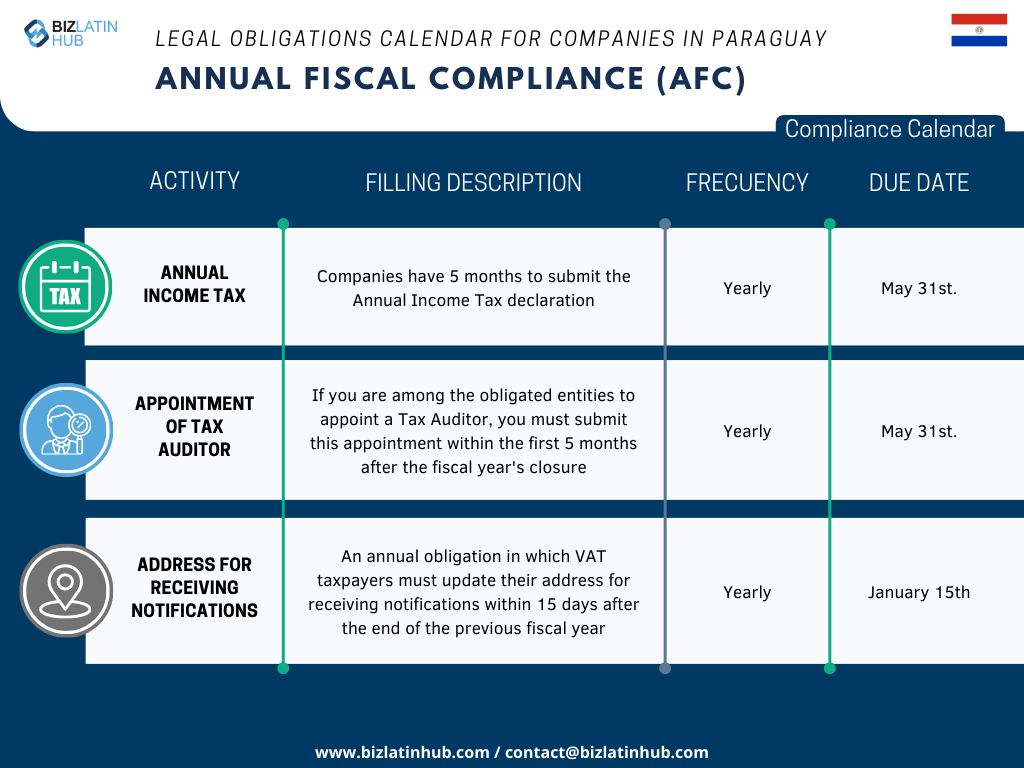

| What are the annual entity fiscal compliance requirements? | You must file your income tax declaration before May 31st. If you are among the obligated entities to appoint a Tax Auditor, you must submit this appointment also by May 31st in Paraguay. |

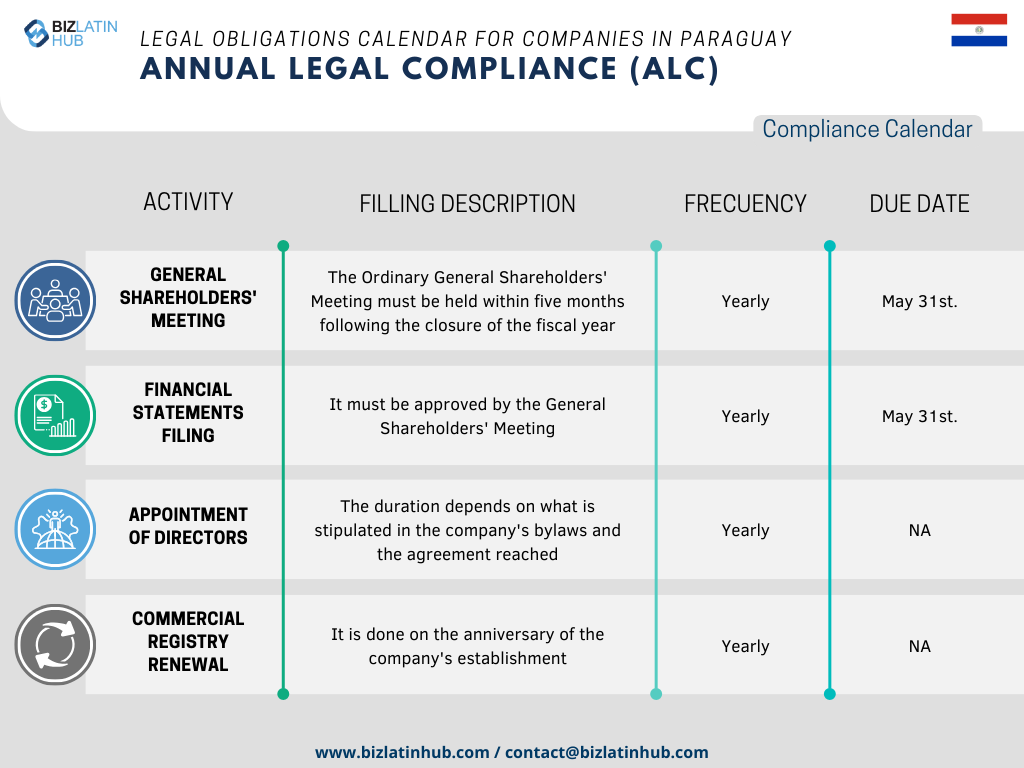

| What are the annual Entity Legal Compliance Requirements? | In Paraguay, the Ordinary General Shareholders Meeting must be held within five months following the closure of the fiscal year and by the deadline of May 31st. |

| What common statutory appointments do companies make in Paraguay? | – An appointed General Director who will be personally liable, both legally and financially for the good operation and standing of the company. – An appointed Company’s Sindico |

| Why Choose to Invest in Paraguay? | Paraguay is one of the most attractive countries for conducting business in South America, partly due to its record of strong economic growth. According to the World Bank, Paraguay has seen a continuous growth rate of 4.5% over the last few years. |

The Importance of Corporate Compliance in Paraguay

When expanding into a new country like Paraguay, a dependable corporate secretarial services provider can aid a company by ensuring compliance with corporate obligations. This allows the company to better manage risk. Setting up operations in a foreign country presents challenges, such as navigating tax regulations, adapting to new business culture, and hiring local talent. Dealing with these challenges can be time-consuming and intricate, especially when language and cultural barriers come into play.

Therefore, collaborating with a trusted local partner, such as a provider of corporate secretarial services in Paraguay, becomes vital to ensure your company aligns with local and international requirements. This partnership empowers executives to focus on devising effective business strategies for their company’s growth.

Furthermore, a reliable corporate secretarial services provider enhances a company’s risk management efforts by ensuring adherence to local regulations and fulfillment of corporate obligations. Avoiding penalties or sanctions from local institutions is crucial for the success of your business in Paraguay.

Avoid penalties or sanctions from local institutions and generate success for your business in Paraguay by seeking an experienced and trusted corporate secretarial services provider.

What Are Some Available Corporate Secretarial Services in Paraguay?

1. Bookkeeping Services

Bookkeeping encompasses the recording, storing, and retrieving of financial transactions, whether for businesses, nonprofit organizations, or individuals. It requires a solid grasp of debits, credits, and financial accounting principles, including knowledge of balance sheets and income statements.

Business owners must bear in mind that bookkeeping and accounting registries are mandatory for every legal entity registered in Paraguay. Even sole proprietor companies must ensure that they are keeping their accounting records according to Paraguayan standards.

It is essential for all legal entities in Paraguay, including sole proprietorships, to maintain accurate accounting records compliant with Paraguayan standards. Companies conducting local activities must also meet specific obligations, including filing annual and/or monthly declarations with the SET (Sub Secretaría de Estado de Tributación).

2. Payroll Support Services

Payroll processing is a another important corporate secretarial service in Paraguay. It involves calculating, documenting, and disbursing employee remunerations, along with making social security contributions.

Companies with employees in Paraguay must file monthly declarations with the IPS (Instituto de Previsión Social). Non-compliance can lead to fines and complications for the company’s legal representatives.

While Paraguayan workers are individually responsible for their Personal Income Tax, once they reach the required income threshold, employers must report all wages paid to employees annually. This information is used to cross-reference data with the social security system.

With a corporate secretarial services provider in Paraguay, foreign businesses avoid the risk of non-compliance with local regulations and government expectations, due to lack of local knowledge. Seek support for hiring and managing your employees, including payroll processing, through professional employer organizations and payroll providers.

3. Auditing or Corporate Health Checks in Paraguay

During entity health checks (akin to audits), independent experts scrutinize a business’s financial reports, accounting records, and legal transactions, with the goal of assess the business’s regulatory “health” and ensuring compliance with local regulations.

Regular corporate health checks safeguard businesses from latent issues that could result in sanctions or other complications with authorities in Paraguay.

Outsourcing corporate secretarial services in Paraguay, including entity health checks, provides ongoing assurance that your company adheres to local legislation. Local legal and accounting experts possess the expertise to identify discrepancies, ensuring your business operates within the bounds of the law. These checks evaluate the business’s standing with relevant government entities.

Beyond ensuring compliance, entity health checks also demonstrate good governance and mitigate risks in Paraguay.

4. Tax Declarations

This service involves the accurate and timely preparation and filing of all required tax declarations as mandated by local tax authorities.

Importance: Complying with local tax regulations is crucial to avoid penalties and ensure the company’s reputable standing. An efficient service ensures accuracy and timeliness when filing declarations, minimizing the risk of errors and ensuring regulatory compliance.

5. Ordinary General Annual Assembly

This service includes the organization of an annual ordinary shareholders’ meeting, with proceedings and decisions published in the Official Gazette.

Importance: The annual assembly is essential for transparency and collective decision-making. Publishing proceedings in the Official Gazette ensures proper disclosure and compliance with regulations.

6. Submit the Financial Statements to the Relevant Authorities

Another important secretarial service involves the submission of financial statements to the relevant authorities, ensuring transparency and compliance with financial obligations.

Importance: This action ensures that companies are financially transparent and compliant with legal obligations. Presenting accurate and easy-to-understand financial statements is crucial for authorities and other stakeholders to assess the company’s financial health.

Most Common Audits in Paraguay

Audit of Annual Accounts for Financial Statements

Be mindful that financial statements in Paraguay need to follow IFRS standards. The financial statement audit checks all transactions, procedures, and balances of a company. The goal of an audit of financial statements is to determine the accuracy of financial reports and verify whether the information on assets and liabilities is in compliance with regulations.

Fiscal Audit

The fiscal audit focuses on a company’s tax obligations. This type of audit will review the annual/monthly declarations of the company and identify any mistakes that may have resulted in overpaying, or underpaying taxes. Fast identification of unnoticed issues is especially important to avoid challenging and/or expensive situations with local authorities and maintain a clean reputation.

The fiscal audit is the most common audit service for companies seeking to outsource to corporate secretarial services providers. Carrying a CCT – Tax Compliance Certificate in Paraguay, issued by the SET is very important, because almost any process, both in the private and public spheres, requires tenure.

Compliance Audit

This type of audit examines if the business conducts its operations according to internal and external standards. This audit is important to determine if your business complies with all general regulations, plus any additional industry-specific obligations and standards.

Expert corporate secretarial services providers in Paraguay will assist you with your auditing needs and de-escalate any issues that may cause problems for your business.

International Taxation

Expanding your business in Paraguay and the broader region requires careful planning, including understanding international tax regulations. International taxation entails structuring, planning, and ensuring compliance with various jurisdictions’ tax requirements.

Corporate secretarial services providers in Paraguay can assist your business in developing strategies to address double taxation and leverage free trade agreements, thereby reducing costs and facilitating rapid growth.

FAQs on Corporate Compliance in Paraguay

Based on our extensive experience these are the common questions and doubts of our clients on entity legal compliance in Paraguay:

The following are the most common statutory appointments for Paraguayan legal entities:

– An appointed General Director who will be personally liable, both legally and financially for the good operation and standing of the company. This person can either be a local national or a foreigner, however, if a foreigner, a certificated lawyer in Paraguay must be designated to act on his/her behalf in front of the Paraguayan tax authorities.

– An appointed Company´s Sindico, which is a minimum statutory requirement for this kind of legal entity in Paraguay.

Yes, a Registered Office Address or local Fiscal Address is required for all entities in Paraguay for the receipt of legal correspondence and government visits.

If you are among the obligated entities to appoint a Tax Auditor, you must submit this appointment within the first 5 months after the fiscal year´s closure and by the deadline of May 31st in Paraguay.

In Paraguay, the Ordinary General Shareholders Meeting must be held within five months following the closure of the fiscal year and by the deadline of May 31st.

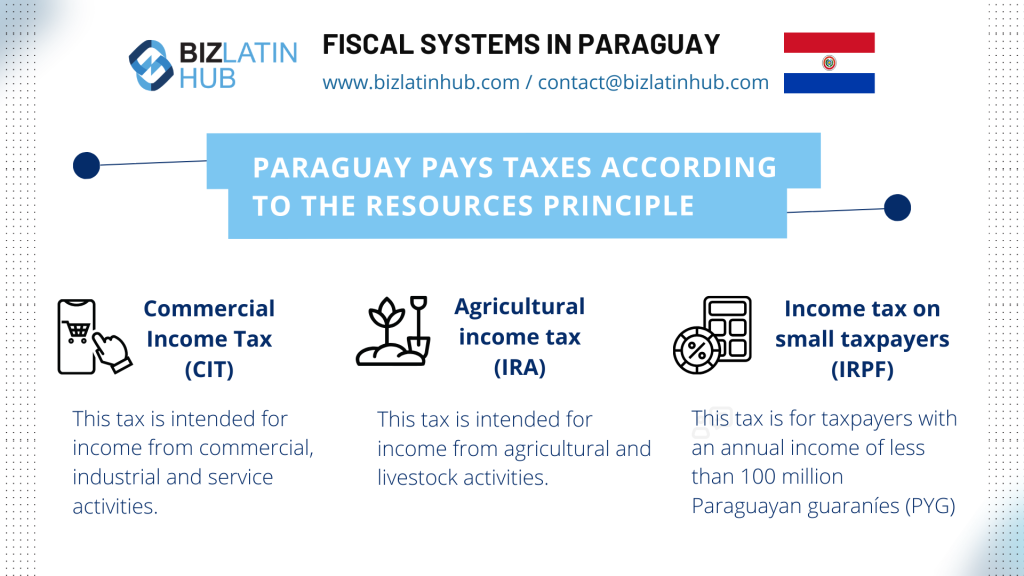

The main taxes to be declared and paid in Paraguay are the following:

Commercial Income Tax (CIT): This tax is intended for income from commercial, industrial and service activities.

Agricultural Income Tax (IRA): This tax is intended for income from agricultural and livestock activities.

Income Tax on Small Taxpayers (IRPF): This tax is for taxpayers with an annual income of less than 100 million Paraguayan guaranies (PYG).

Engage with Trusted Providers of Corporate Secretarial Services in Paraguay

Expanding into Paraguay can be a complex process, but luckily, the country is well-known for its wealth in legal and financial expertise. Make sure to satisfy your taxation, HR, and legal needs with a trusted, responsive, and efficient corporate secretarial services provider in Paraguay.

At Biz Latin Hub, we help businesses from all over the world to enter and operate in Paraguay and Latin America. Our team of local and expatriate lawyers and accountants has vast experience in tax compliance, company incorporation, auditing, and visa services.

Contact us today for a consultation.

Learn more about our team and expert authors.