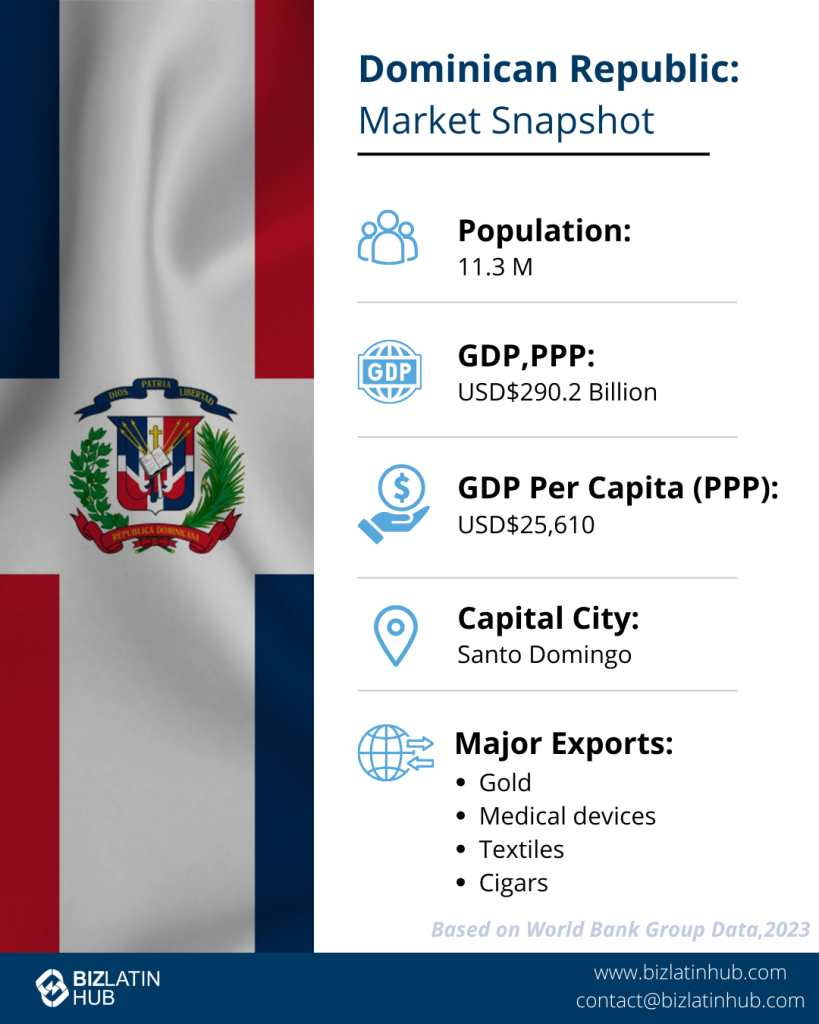

Deciding to incorporate a company in the Dominican Republic offers significant opportunities for foreign investors, given its strong economic growth, investment incentives, and strategic location in the Caribbean. To successfully establish a company in the Dominican Republic, it is essential to follow the required steps and comply with local corporate laws. Biz Latin Hub provides tailored support and comprehensive back-office services to guide you through doing business in the Dominican Republic, ensuring your company’s success in this dynamic market.

Key Takeaways On How To Incorporate a Company in the Dominican Republic

| Is Foreign Ownership Permitted? | Yes, businesses can be owened 100% by foreign individuals or entities in the Dominican Republic. |

| Steps to Incorporate a Company in the Dominican Republic | Step 1 – Check Company Name Availability. Step 2 – Agree on the constitution and create the bylaws. Step 3 – Sign the Constitution Act. Step 4 – Payment of Duties, Stamps, and Taxes. Step 5 – Register the company with the tax authority and other institutions. Step 6 – Open a corporate bank account. |

| What Are The Common Entity Types To Incorporate a Company in the Dominican Republic? | Foreign Branch Office. Limited Liability Company (SRL). Sociedad Anónima (SA). Simplified Public Limited Company (SAS). |

| Why Set-up a Business in the Dominican Republic? | The Dominican Republic offers a strategic location, strong economic growth, investment incentives, a skilled workforce, and advanced infrastructure, making it an ideal market for foreign investors seeking expansion. |

How to Incorporate in the Dominican Republic

Here are the 6 steps to help you incorporate an entity in the Dominican Republic:

- Step 1 – Check Company Name Availability.

- Step 2 – Agree on the constitution and create the bylaws.

- Step 3 – Sign the Constitution Act.

- Step 4 – Payment of Duties, Stamps, and Taxes.

- Step 5 – Register the company with the tax authority and other institutions.

- Step 6 – Open a corporate bank account.

Step 1- Check Company Name Availability

To make your company stand out and grab people’s attention, it’s important to create a unique and high-quality brand, product, or service. The most effective way for customers to remember your brand is by selecting a clear and unique company name.

To ensure your business name is unique in the Dominican Republic, it’s a good idea to consult a local expert and check if the name is available in the Mercantile Registry database. Taking an active approach in checking name availability will help guarantee that your company name is distinguishable from others and compliant with registration requirements.

Step 2 – Agree on the constitution and create the bylaws

Once you have chosen the legal entity type, company name, initial amount of capital, and business purpose, you must draft the internal regulations of the company, commonly referred to as bylaws or company constitution.

It is an important step in incorporating a company in the Dominican Republic. Done successfully, it ensures the smooth functioning and effective administration of the company. The bylaws are a legal framework that will guide the partners and members of the board of directors on restructuring the company in the future.

Step 3 – Sign the Constitution Act

It needs to be completed before a public notary. The shareholders must announce that they have completed the following tasks:

- Been formally appointed during a meeting of partners.

- Agreed to incorporate the company.

- Verified the constitution.

- Signed the deed of incorporation.

Once this step is done, the company is officially registered before the Commercial Registry.

Step 4 – Payment of Duties, Stamps, and Taxes

Before you finish incorporating a company in the Dominican Republic, you must pay the effective fees, taxes, and stamps, as determined by legal regulations.

The commercial register will then assess the incorporation application. If approved, your new company is written into law.

Step 5 – Register the company with the tax authority and other institutions

Before starting business operations, you must register your newly incorporated company with the National Taxpayers Registry (RNC). This registration process requires you to provide details about the economic activity you plan to undertake. If you intend to hire employees, you may have to complete additional social security obligations.

Please register in advance with the RNC to ensure operations down the line, including opening a corporate bank account.

It is crucial to have a well-prepared business strategy with carefully scheduled timelines to avoid delays during the company incorporation process. This will enable you to establish a fully operational company without unnecessary complications.

Step 6 – Open a corporate bank account

To finish incorporating a company in the Dominican Republic, you will need to open a corporate bank account. Wait times and requirements on what documentation you need may vary from bank to bank.

Generally speaking, you need to provide the bank with information on your company’s activities, shareholder details, and tax identification.

These are some banks in the Dominican Republic:

- Banco Popular.

- Scotiabank.

- Banco Reservas.

- Banco BHD.

Types of Business Entities in the Dominican Republic

When forming a company in the Dominican Republic, you have the option to choose from eight types of legal entities. Below are the most common entity types:

- Foreign Branch Office.

- Limited Liability Company (SRL).

- Sociedad Anónima (SA).

- Simplified Public Limited Company (SAS).

1. Foreign Branch Office

In the Dominican Republic, a foreign company is referred to as a Foreign Branch Office, which is the same terminology used in neighboring countries. Within the framework of the Foreign Branch Office, a Manager or Director is entrusted with the authority to legally represent the company and undertake its operations within the jurisdiction of the Dominican Republic.

It is mandatory for the capital invested in the Foreign Branch Office to correspond to the capital amount registered by the parent company. This requirement ensures parity and consistency between the registered capital of the parent company and the capitalization of the Foreign Branch Office.

2. Limited Liability Company (SRL)

The Sociedad de Responsabilidad Limitada (SRL) is the Spanish term for what is essentially a Limited Liability Company. It is formed with a minimum of 2 shareholders and a maximum of 50. The management structure of an SRL is simpler than other types of companies, as it can be overseen by a Manager and/or a Sub-Manager who serves as the legal representatives of the company. Their appointment typically lasts for six years.

Unlike other types of companies, forming an SRL does not come with a minimum share capital requirement. However, there is a minimum amount per share set at RD$100. This indicates that the SRL usually operates with a smaller structure, making it suitable for businesses of varying sizes. Each legal entity type varies significantly and selecting the best one for your business is crucial to ensuring success when deciding to incorporate a company in the Dominican Republic.

3. Sociedad Anónima (SA)

A Sociedad Anónima (SA) is a commercial enterprise that is formed with a minimum of 2 or more stakeholders. These stakeholders can be either domestic or international. The SA operates under the governance of a board of directors, which must have at least three members who are appointed for a 6-year term. Reappointment of directors is permissible upon completion of their previous term.

Investments in the company are represented by transferable financial instruments known as shares. There is no upper limit to the share capital. However, a minimum capital of RD$30,000,000 is required for all SA companies registered in the Dominican Republic.

4. Simplified Public Limited Company (SAS)

The Simplified Public Limited Company (SAS) is similar to a Public Limited Company. Unlike the Public Limited Company, the SAS offers greater contractual freedom when created and the bylaws drafted.

The SAS is constituted with a minimum of two shareholders and managed by a board of directors of at least three members. The minimum share capital required to form a SAS in the Dominican Republic is around RD$3,000,000.

| Summary of the Types of Entities in the Dominican Republic | |

|---|---|

| Foreign Branch Office | |

| A foreign company is referred to as a Foreign Branch Office | The capital invested in the Foreign Branch Office must correspond to the amount registered by the parent. |

| Limited Liability Company (SRL) | |

| The Sociedad de Responsabilidad Limitada (SRL) is similar to a Limited Liability Company | It is formed with a minimum of 2 shareholders and a maximum of 50. |

| Sociedad Anónima (SA) | |

| A commercial enterprise that is formed with a minimum of 2 or more stakeholders. | A minimum capital of RD$30,000,000 is required for all SA companies registered in the Dominican Republic. |

| Simplified Public Limited Company (SAS) | |

| The Simplified Public Limited Company (SAS) is similar to the Public Limited Company. | The minimum share capital required to form a SAS in the Dominican Republic is around RD$3,000,000. |

Tax and Compliance Overview

Once your company is legally incorporated and registered with the Chamber of Commerce (Cámara de Comercio y Producción), the next critical step is obtaining an RNC (Registro Nacional de Contribuyentes) through the Dirección General de Impuestos Internos (DGII) — the Dominican Republic’s national tax authority.

The RNC is your company’s official tax ID number, and it is required for:

- Issuing legal invoices (facturas con valor fiscal)

- Opening a corporate bank account

- Submitting monthly and annual tax declarations

- Making social security and employee withholding payments

In addition, most businesses must register for ITBIS (Impuesto a la Transferencia de Bienes Industrializados y Servicios) — the Dominican Republic’s value-added tax system, equivalent to VAT or GST. The standard ITBIS rate is 18%, and companies must:

- Charge this tax on most goods and services

- Submit monthly ITBIS returns to the DGII

- Maintain proper accounting records and fiscal receipts (comprobantes fiscales)

Failure to comply with RNC or ITBIS obligations can result in fines, delayed reimbursements, and loss of access to key business services. Biz Latin Hub supports companies in handling all RNC registrations, setting up electronic invoicing, and managing ITBIS filing requirements on an ongoing basis.

Municipal Licensing and Social Contributions

In addition to national-level registrations, businesses operating within a specific city or municipality may be required to obtain a municipal license (Licencia Municipal or Patente Municipal). While not all activities require this license, it is commonly needed for:

- Commercial premises (retail stores, restaurants, etc.)

- Regulated industries (healthcare, education, hospitality)

- Businesses operating in urban zones

The license is issued by the local Ayuntamiento (city council) and typically involves an annual fee based on the company’s location and economic activity. Biz Latin Hub can help assess whether your company is subject to municipal licensing and assist with the application process.

Additionally, companies must register with Tesorería de la Seguridad Social (TSS) to manage payroll and comply with social contributions. Employers are obligated to make monthly payments covering:

- Pensions and retirement (AFP)

- Health insurance (SENASA)

- Occupational risk coverage (INFOTEP and other contributions)

These contributions are mandatory when hiring employees and must be reported through the Dominican Republic’s integrated electronic system.

FAQs About Incorporating a Company

Based on our extensive experience these are the common questions and doubts of our clients regarding company formation in the Dominican Republic:

1. Why is the Dominican Republic good for doing business?

The Dominican Republic is good for business due to its stable economic growth, strategic location, expanding tourism industry, and government incentives for foreign investment.

2. What is the process to register a business in the Dominican Republic?

Start by choosing a legal structure (commonly an SRL), reserve your company name through ONAPI, draft and notarize the bylaws, and register with the Mercantile Registry. Then obtain your RNC (tax ID) from the DGII and open a corporate bank account. If you plan to operate locally, you’ll need a municipal license.

3. What taxes must companies pay?

Corporate income tax is 27%, and VAT (ITBIS) is 18%. Companies must register for an RNC, file monthly, and contribute to social security when hiring.

4. What is the Dominican Republic Company Tax ID?

The Dominican Republic Company Tax ID is the RNC (Registro Nacional de Contribuyentes), which translates in English to National Taxpayer Registry which is issued by the National Tax Authority.

5. What are the incorporation requirements?

Minimum shareholders (based on entity type), legal representative (can be foreign), company address, and legal documents in Spanish. Foreign shareholders must present apostilled documents.

6. How long does it take to form a business in the Dominican Republic?

Expect around 2 to 4 weeks, including name registration, tax setup, and bank account opening.

7. Can a foreigner own a business in the Dominican Republic?

Yes, a foreigner can own a business in the Dominican Republic.

8. What company types are available?

You can choose from SRL, SA, or EIRL.

9. What is an LLC called in the Dominican Republic?

The equivalent of an LLC in the Dominican Republic is called a Sociedad de Responsabilidad Limitada (SRL).

Why incorporate a company in the Dominican Republic?

The Dominican Republic is the ideal market to expand into for many reasons. It has a favorable business environment, with the government providing foreign investors with tax incentives and other benefits.

Some of the major benefits of incorporating a company in the Dominican Republic include:

- Strategic Geographic Location.

- Strong Economic Growth.

- Investment Incentives.

- Skilled Workforce.

- Infrastructure Development.

- Strategic Geographic Location: Situated in the heart of the Caribbean, the Dominican Republic enjoys a strategic position with access to North and South American markets. Its proximity to the United States and Latin American countries makes it a convenient hub for regional operations.

- Strong Economic Growth: The Dominican Republic has experienced robust economic growth in recent years, driven by the following sectors: tourism, manufacturing, agriculture, and services. Strong economic growth creates a favorable business environment and provides opportunities for companies to thrive.

- Investment Incentives: The government of the Dominican Republic actively promotes foreign investment by offering attractive incentives and benefits. These include tax exemptions, free trade zones, streamlined procedures, and investment protection laws. Such incentives contribute to the country’s competitiveness and make it an appealing destination for investment.

- Skilled Workforce: The Dominican Republic has a well-educated and skilled workforce. The country’s emphasis on education and vocational training ensures a talented pool of professionals across different industries.

- Infrastructure Development: The island nation has invested significantly in infrastructure development, including transportation, telecommunications, and energy. The country’s reliable infrastructure supports business operations and facilitates connectivity within and with international markets.

Incorporate a Company in the Dominican Republic With Biz Latin Hub

The Dominican Republic has many opportunities for businesses and investors to expand into Central America and the Caribbean. Once you decide to incorporate a company in the Dominican Republic, consult a local legal expert to ensure you correctly navigate corporate regulations and adhere to all aspects of local tax and accounting legislation.

Biz Latin Hub is a market entry and back-office services leader in Central and South America. Our legal and accounting specialists are your point of contact for multilingual support for forming a company in the Dominican Republic. Reach out to us, here at Biz Latin Hub for personalized advice and support. Learn more about our team and expert authors.