Corporate entity regulatory compliance is crucial when registering a business in Ecuador, enshrining compliance from the beginning and as your company expands. This will avoid you inadvertently breaking the law and facing consequences. Our guide highlights key compliance considerations and provides strategies to avoid non-compliance, taking into account Ecuador’s current economic landscape. Biz Latin Hub, with extensive expertise in Latin America, we can assist you in navigating these regulations and ensure your success in a flourishing market. This guide details the primary obligations and reporting requirements necessary to maintain a company in good legal standing in Ecuador.

Key Takeaways On Corporate Entity regulatory compliance In Ecuador

| Fiscal Address Requirements: | A registered office address or fiscal address is required for all entities in Ecuador for all offical correspondence |

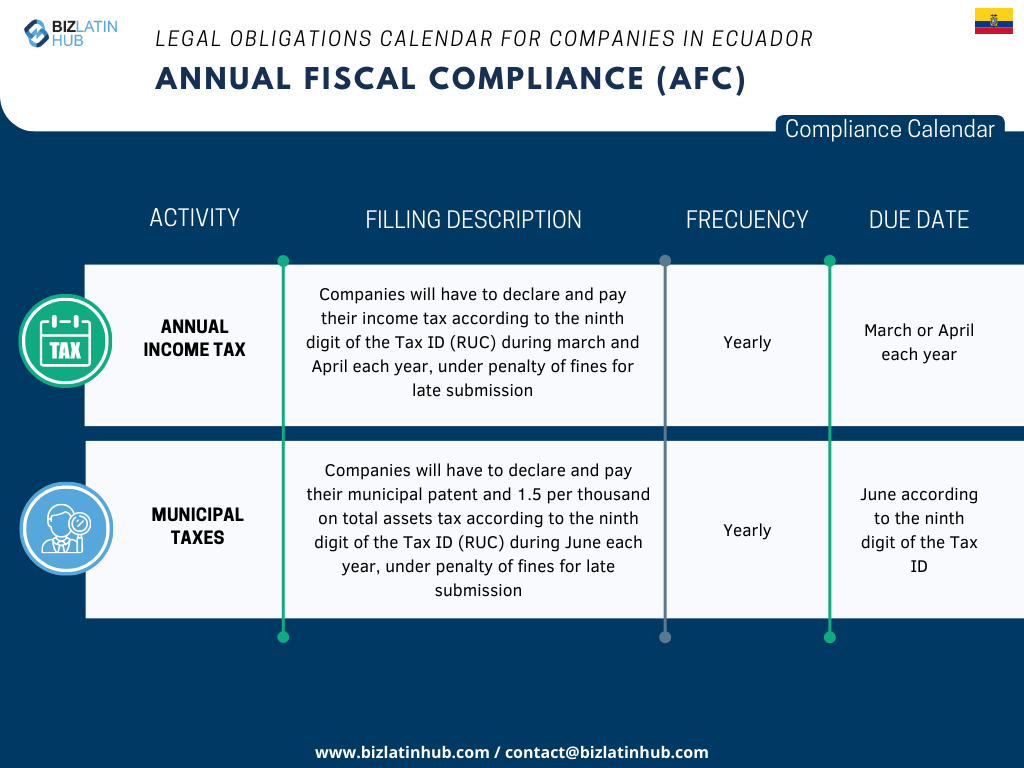

| What Are The Steps To Annual Fiscal Compliance? | Annual Income Tax Municipal Taxes |

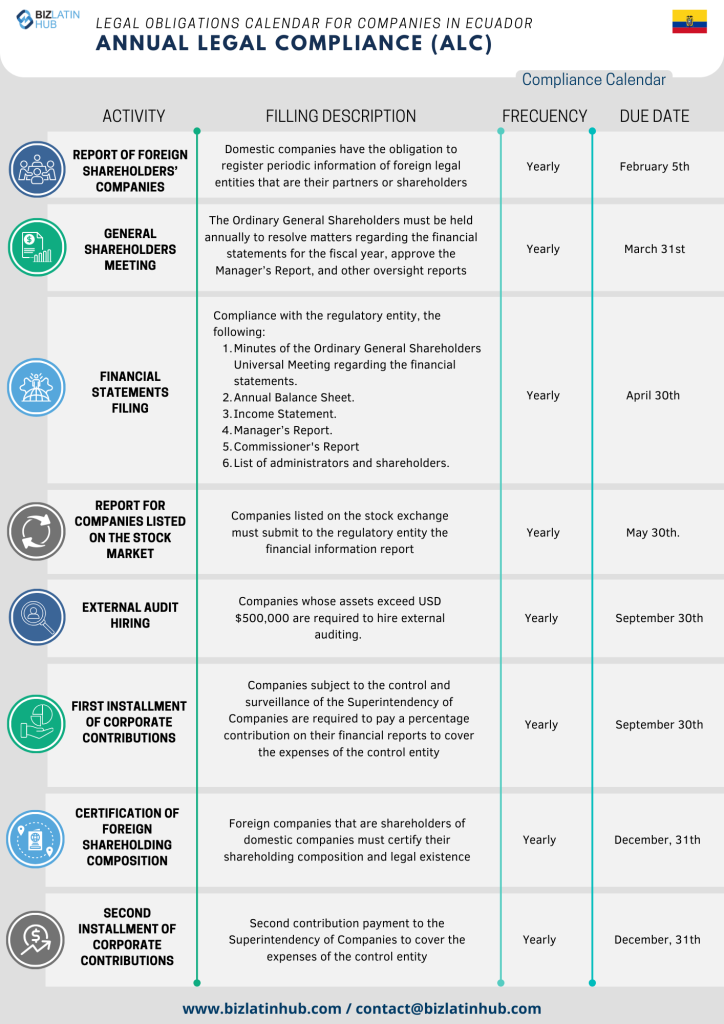

| What Are The Steps To Annual Legal Compliance? | Report of Foreign Shareholders Companies General Shareholders Meeting Financial Statements Filing Report for Companies Listed on the Stock Market External Audit Hiring Corporate Contributions Certification of Foreign Sharholding Composition |

| Why Invest in Ecuador? | Ecuador provides access to diverse ecosystems, a dollarized economy, and a strategic location for trade in South America. |

| What are the primary annual reports required by the Superintendence of Companies? | All foreign-owned companies must submit an updated list of shareholders annually. The legal representative must prepare and submit a detailed annual report. |

| What is the deadline for submitting annual financial statements? | The deadline for filing financial statements in Ecuador is April 30th. Failure to meet compliance deadlines results in financial penalties. |

Ecuador’s Annual Corporate Compliance Requirements

Entity annual compliance in Ecuador requires that the following issues be discussed and resolved in a corporation’s annual shareholder meeting:

- Annual Shareholders Meeting

- Annual Strategy Report

- Update and Maintain Corporate Books

- Profit and Loss Report

- Disclosing Foreign Shareholders or UBO Report

- Reports to Regulatory Bodies

- Company Structure

1. Annual Shareholders Meeting

A shareholders’ meeting must be convened at least once annually within the first three months of the year. The purpose of this meeting is to approve accounts, financial statements, and the administration of the legal representative.

2. Annual Strategy Report

Company management has the obligation of presenting the shareholders with an annual report of their activities, and how they relate to the company’s financial statements. These reports must provide a detailed explanation of the financial strategy throughout the year, for all aspects of the company (labor, marketing, sales, etc.) This report is a compulsory part of the annual shareholder meeting and shareholders must approve the report.

3. Update and Maintain Corporate Books

Part of legal entity compliance is having corporate books up to date.

4. Profit and Loss Report

Shareholders must be made aware of the company’s financial performance for the past year. Shareholders must be informed about the profit level (was it higher or lower than forecasts predicted?) and if applicable, explain why the company suffered a quarterly loss.

5. Disclosing Foreign Shareholders or UBO Report

Compliance regulations stipulate that the number of foreign shareholders be reported, as well as how much of the company’s stock they own. Each year, before January 31st a company must provide the names, nationalities, and contact information of foreign shareholders to the appropriate government authorities. If a shareholder is a foreign company and not an individual, the name, nationality, and contact information of the representative of the institutional shareholder must be reported.

Expert Tip: Apostille and Translation of Foreign Documents

Our experience shows that the most common delay in annual compliance for foreign-owned companies is the incorrect preparation of shareholder documents. Any required document from outside Ecuador, such as a Certificate of Good Standing for a parent company, must first be apostilled in its country of origin. After the apostille, the document must be translated into Spanish by an officially certified translator in Ecuador. We recommend starting this process at least two months before the filing deadline to prevent delays that can lead to penalties.

6. Reports to Regulatory Bodies

Compliance rules and regulations also stipulate that a company needs to carry out the following actions: Make available a report detailing the discussions and decisions ratified at the annual shareholder meeting; Send all relevant compliance documents to the superintendency.

7. Company Structure

Depending on the type of structure of the company (public, limited liability, SAS, etc.) there are additional requirements that must be met. This is where the corporate secretary again becomes essential, as it will be her/his duty to inform company management about the additional items/actions that will be needed to ensure corporate compliance.

Financial compliance requirements

The presentation of financial statements is important so that shareholders understand the company’s economic activities. These details also need to be communicated to shareholders at annual shareholder meetings, and include information such as how much the company made in overall profit, gross vs. net revenues, operating expenses, etc. Annual financial reports must be sent to the Ecuadorian tax authority every year.

The Role of the Superintendence of Companies

The Superintendence of Companies is the Ecuadorian government entity responsible for the supervision and control of corporations. It ensures that companies operate according to the law by requiring the submission of specific legal and financial reports. All annual compliance filings are submitted through its online portal.

FAQs on entity legal compliance in Ecuador

Based on our extensive experience these are the common questions and doubts of our clients on regulatory compliance in Ecuador:

– An appointed legal representative (“often referred to as General Manager”) who will be personally liable, both legally and financially, for the good operation and standing of the company. This should be a local national or a foreigner with the right to live/work in the country.

– A Certified Local Accountant (CPA) registered with the authorities on behalf of the company.

– A shareholder’s legal representative for each foreign shareholder. This person can either be a local national or a foreigner with residency in Ecuador.

Yes, a registered office address or fiscal address is required for all entities in Ecuador for the receipt of legal correspondence and governmental visits.

Companies in Ecuador will have to declare and pay their income tax according to the ninth digit of the Tax ID (RUC) during March and April each year, under penalty of fines for late submission.

The Ordinary General Shareholders Meeting must be held annually to resolve matters regarding the financial statements for the fiscal year, and approve the Manager’s Report as well as other oversight reports. The deadline for doing this is March 31st in Ecuador.

When filing financial statements in Ecuador, a company must include the following features:

Minutes of the Ordinary General Shareholders Universal Meeting regarding the financial statements

Annual Balance Sheet

Income Statement

Manager’s Report

Commissioner’s Report

List of administrators and shareholders

The deadline for filing financial statements in Ecuador is April 30th.

Foreign-owned companies must fulfill the same annual compliance requirements as domestic companies, with one additional obligation: the submission of an updated report on all foreign shareholders. This includes providing legally apostilled and translated documentation for any corporate entities in the ownership structure.

A Certificate of Good Standing (Certificado de Cumplimiento de Obligaciones) is an official document issued by the Superintendence of Companies. It serves as proof that a company has submitted all required annual reports and has no outstanding fines or penalties. Banks and other institutions often require this certificate.

No. An external audit of the annual financial statements is only mandatory for companies whose total assets exceed USD$500,000 at the close of the fiscal year. Companies below this threshold can submit their unaudited financial statements.

Why Choose to Invest in Ecuador?

There are stringent regulations for entity annual compliance in Ecuador for companies operating in the territory. Each industry (oil and gas, mining, banking, corporate finance, etc.) has its own set of rules, regulations, and statutory requirements which companies must comply with.

Ecuador is an attractive destination for investment, thanks to its strategic location, rich natural resources, and diversified economy. The agriculture sector stands out, with Ecuador being a leading global exporter of bananas, shrimp, and flowers, supported by fertile land and favorable climate. Diversification into high-demand products like cocoa and coffee further strengthens its position. Additionally, government investment in infrastructure, such as modernized ports and highways, enhances export efficiency and supports growth.

Renewable energy is another promising sector, leveraging Ecuador’s abundant hydroelectric resources and expanding into wind, solar, and geothermal projects. The tourism industry also thrives, with iconic attractions like the Galápagos Islands and the Amazon rainforest drawing global visitors. Combined with a dollarized economy, favorable tax policies, and a focus on sustainability, Ecuador offers diverse opportunities for investors.

Biz Latin Hub can help with entity annual compliance in Ecuador

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in Bogota and Cartagena, as well as over a dozen other major cities in the region. We also have trusted partners in many other markets.

Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross-border operations.

As well as knowledge about entity annual compliance in Ecuador, our portfolio of services includes hiring & PEO, accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to find out more about how we can assist you in finding top talent, or otherwise do business in Latin America and the Caribbean. If this article on entity annual compliance in Ecuador was of interest to you, check out the rest of our coverage of the region. Or read about our team and expert authors.