A growing number of companies are considering company formation in the Dominican Republic, but this involves certain amounts of ongoing maintanence. While it may be complex, financial regulatory compliance in the Dominican Republic is relatively straightforward once you know the basics, and this is where Biz Latin Hub can step in to help out. The Dirección General de Impuestos Internos (DGII) is the tax authority responsible for implementing fiscal and customs legislation in the Dominican Republic. This guide outlines the recurring legal obligations required to maintain good standing with the Chamber of Commerce and the Tax Authority (DGII).

Key Takeaways On Regulatory Compliance in the Dominican Republic

| Fiscal Address Requirements: | A registered office address or fiscal address is required for all entities in the Dominican Republic for the receipt of legal correspondence and governmental visits. |

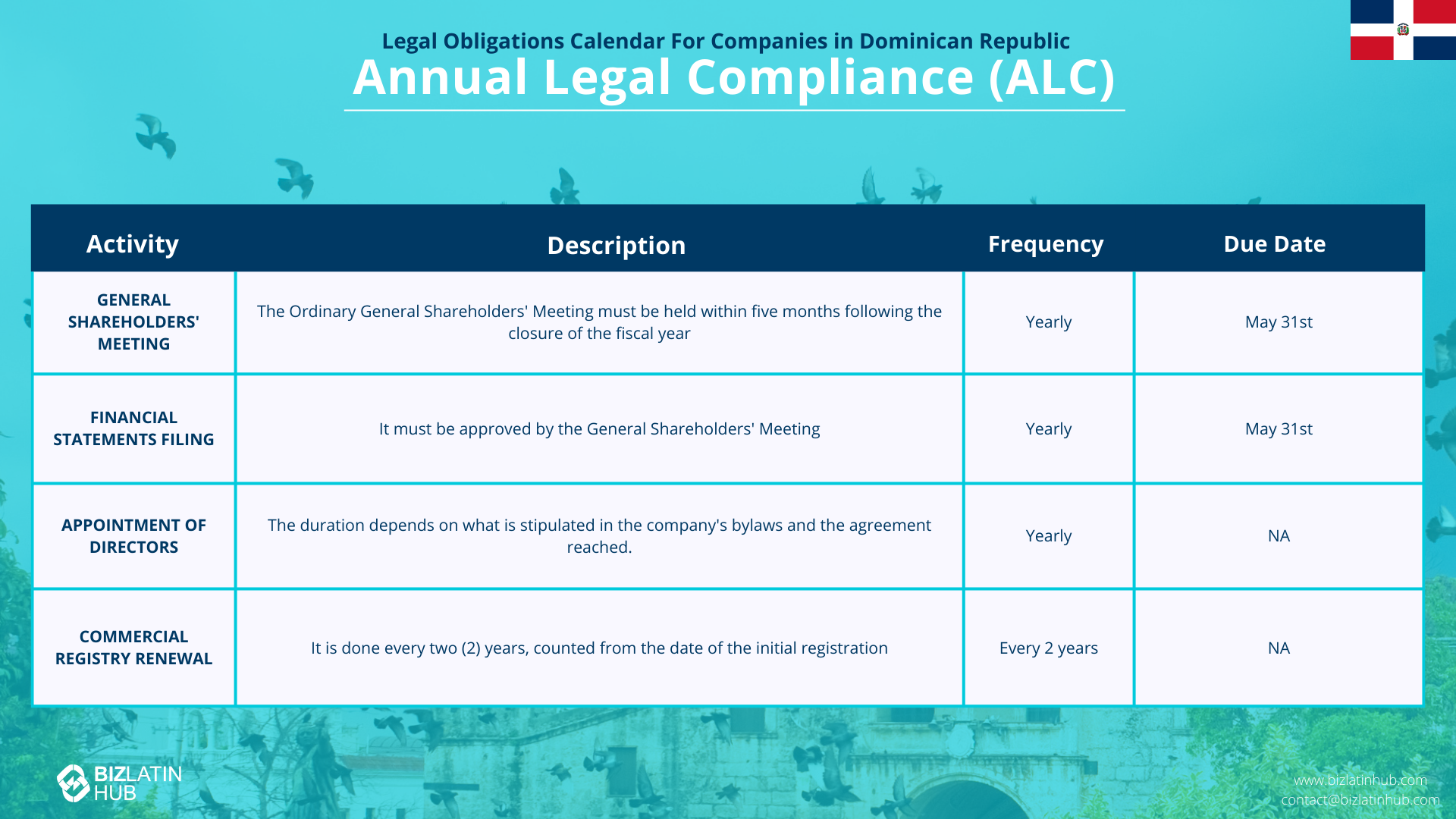

| What Steps Are There For Annual Legal Compliance? | General Shareholders Meeting Financial Statements Filing Appointment of Directors Commercial Registry Renewal |

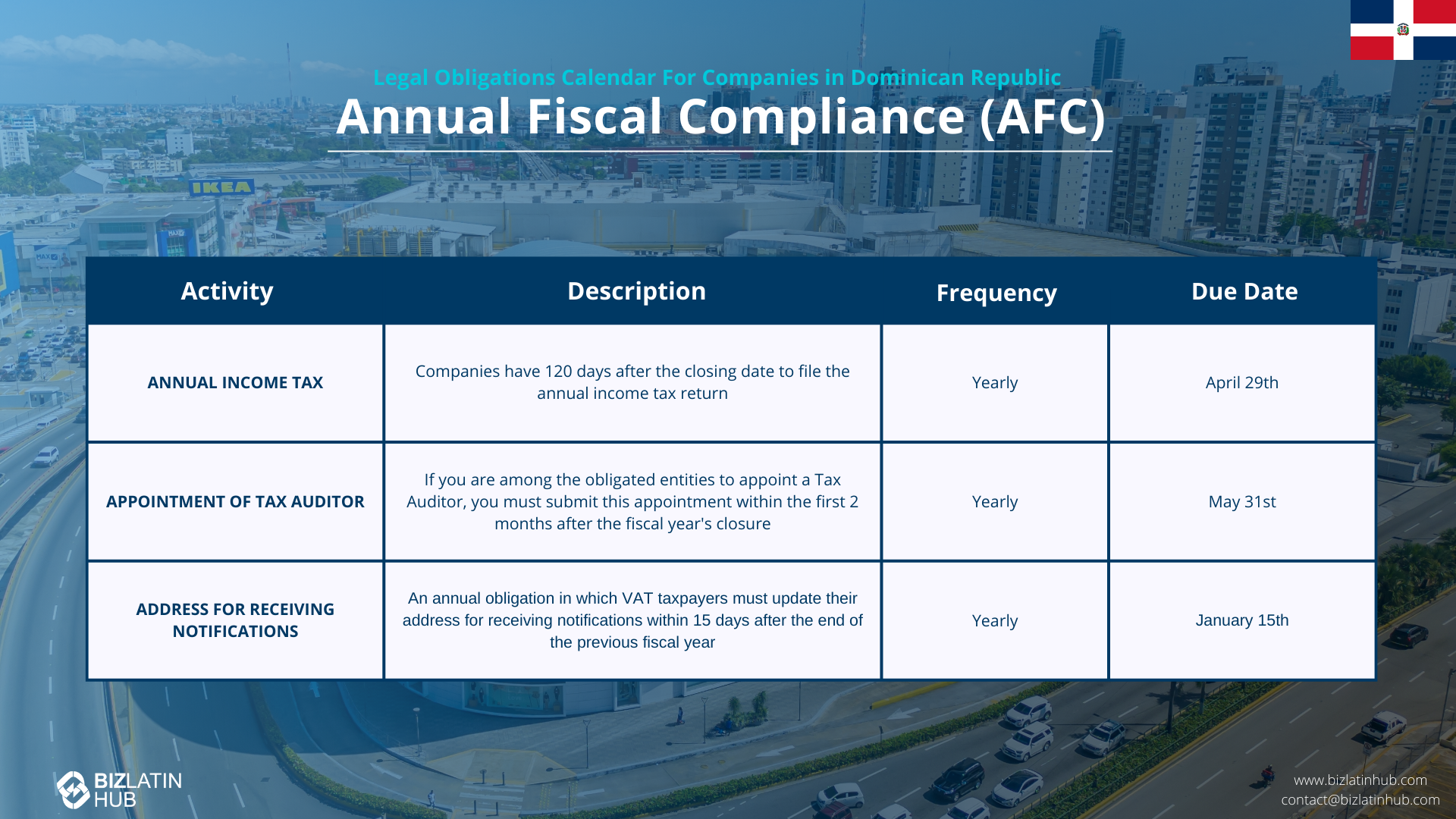

| What Steps Are There For Annual Fiscal Compliance? | Annual income Tax Appointment of Tax Auditor Address for Recieving Correspondence Companies must update their UBO information with the DGII. The Mercantile Registry must be renewed every two years. |

| Why Invest in the Dominican Republic? | Its strategic location and diverse industries, including agriculture, manufacturing, and services, attract investors. |

| What financial checks are there? | Tax filings (IR-2) must align with approved financial statements. |

Overview of Financial Regulatory Compliance in the Dominican Republic

The details surrounding corporate entity regulatory compliace in the Dominican Republic depend on the type of company, but some aspects of corporate compliance are generally applicable.

- Company Tax Registration

- Upkeep of Company Books

- Provision of Registered Address

- Holding an Annual General Meeting (AGM) of Shareholders

- Renewal of the Commerical Registry

- Filing of Annual Corporate Income Tax Return (IR-2 Form)

Each of the following responsibilities will need to be understood and planned for accordingly to ensure your business remains within the law and avoids any avoidable pitfalls.

1. Company Tax Registration

If you start a business or form a branch in the Dominican Republic, you must register with the local tax authority and obtain a tax ID number.

2. Upkeep of Company Books

All companies are obliged to maintain their company books as part of financial regulatory compliance in the Dominican Republic. This is something that a provider of corporate secretarial services will do on your behalf. The IR-2 Form is the annual corporate income tax return that companies must file with the DGII.

3. Provision of Registered Address and Representative

Having a registered address is a minimum statutory requirement for all legal entities in the Dominican Republic. This address will be used for all official communication and correspondence. The legal representative must be a resident of the Dominican Republic and is responsible for the company’s legal compliance.

4. Holding an Annual General Meeting (AGM) of Shareholders

Companies must hold an AGM within 90 days of the end of the fiscal year to approve financial statements and discuss company matters. In keeping with the General Law of Companies and Limited Liability Individual Enterprises, every company or corporation registered in the Commercial Registry of the Chamber of Commerce and Production must hold at least one AGM between shareholders and managing executives. This meeting must be held within 90 days of the end of the fiscal year, which runs from 1 January to 31 December, meaning an AGM must be held no later than 31 March the following year.

5. Renewal of the Commercial Registry

The Commercial Registry of the Chamber of Commerce and Production charges a bi-annual registry fee, due on the date of the original registry. The payment of this fee is mandatory and is required before you can file or registry any commercial act or document. It is therefore an important aspect of financial regulatory compliance in the Dominican Republic.

Expert Tip: The Two-Year Renewal Cycle

From our experience, the most common compliance lapse in the DR is the Mercantile Registry renewal. Unlike many countries with annual renewals, the DR requires renewal every two years. Because it is not an annual habit, it is easily forgotten. However, an expired registry means the company cannot clear goods through customs, bid on contracts, or open bank accounts. We advise clients to set a strict calendar reminder for this biennial obligation.

6. Filing of Annual Corporate Income Tax Return (IR-2 Form)

The corporate income tax return (Form IR-2) must be filed and paid within 120 days of the end of the fiscal year, meaning that corporate income tax must be filed and paid by 30 April following the close of a given fiscal year.

Penalties for Non-Compliance in the Dominican Republic

Non-compliance with corporate legal obligations in the Dominican Republic can result in significant legal and operational consequences. Failure to comply with annual obligations can result in fines, suspension of the tax identification number, and legal actions against company administrators. Common penalties include:

- Suspension of Tax Identification Number (RNC): Businesses cannot operate legally if their RNC is suspended.

- Fines from Regulatory Authorities: The DGII may impose fines for late or incorrect filings.

- Legal Actions Against Administrators: Company administrators may face personal liability for non-compliance, leading to legal actions and potential disqualification from holding management positions.

- Restriction on Business Operations: Companies failing to comply with regulations may face restrictions on their business activities.

- Negative Impact on Creditworthiness: Non-compliance can adversely affect the company’s credit rating, making it difficult to secure financing or conduct business with partners.

Ultimate Beneficial Owner (UBO) Registry

The Dominican Republic has implemented strict rules regarding the identification of Ultimate Beneficial Owners. Companies must declare their UBOs to the DGII. Failure to keep this information updated can result in the suspension of the company’s Tax ID (RNC), preventing it from issuing invoices.

FAQs on Financial Regulatory Compliance in the Dominican Republic

Based on our extensive experience these are the common questions and doubts of our clients on regulatory compliance in the Dominican Republic:

The following are the most common statutory appointments for Dominican legal entities:

– An appointed legal representative who will be personally liable, both legally and financially, for the good operation and standing of the company. This should be a local national or a foreigner with the right to live/work in the country.

Yes, a registered office address or fiscal address is required for all entities in the Dominican Republic for the receipt of legal correspondence and governmental visits.

Some benefits of registering a subsidiary in the Dominican Republic include the following:

A parent company can significantly reduce its tax liability

There are cases in which the parent company manages to increase the efficiency of its operations through one or more subsidiaries

Freedom to create its own corporate governance methods and adopt its own identity

Risk reduction

Companies have 120 days after the closing date to file an annual income tax return by the deadline of April 29th in the Dominican Republic.

The Ordinary General Shareholders Meeting must be held within five months following the closure of the fiscal year and by the deadline of May 31st in the Dominican Republic.

Companies must register with the local tax authority, maintain company books, provide a registered address, hold an Annual General Meeting (AGM) of shareholders, renew the commercial registry, and file the annual corporate income tax return (IR-2 Form).

The legal representative is responsible for ensuring the company’s compliance with local laws, representing the company in legal matters, and signing official documents.

Yes, a registered office address or fiscal address is required for all entities to receive legal correspondence and governmental visits.

Companies must file the annual corporate income tax return (IR-2 Form) and may need to appoint a tax auditor, depending on the company’s size and activities.

Non-compliance can lead to penalties, including fines, suspension of the company’s tax identification number, and potential legal actions against the company’s administrators.

After the Annual Assembly, the minutes approving the financial statements and the updated list of shareholders must be registered with the Chamber of Commerce.

Why invest in the Dominican Republic?

Despite its small size, the Dominican Republic is the eighth-largest economy in the region by gross domestic product (GDP). It is also a popular destination for foreign investors looking to enter Latin America and the Caribbean. Between 2004 and 2022, the GDP of the Dominican Republic saw a four-fold increase, reaching USD$101.65 billion in 2022.

Taking purchasing power into account, the Dominican Republic’s per capita GDP positions it ahead of formidable regional counterparts such as Brazil and Mexico. The country’s economic landscape reflects a strategic approach to business, which has ensured Dominican companies are competitive in the Latin American market.

The Dominican Republic’s business environment benefits from more than 75 free-trade zones (FTZs), which offer significant tax incentives and host companies from a wide range of sectors. In recent years, the tech and call center industries have seen major investment. However, taking advantage of the opportunities on offer in the Dominican Republic requires adherence to the country’s financial regulations.

Biz Latin Hub can help with financial regulatory compliance in the Dominican Republic

At Biz Latin Hub, our locally-based team of bilingual corporate legal and accounting experts is able to assist you with financial regulatory compliance in the Dominican Republic, as part of our portfolio of back-office services.

We provide company formation, accounting & taxation, legal services, hiring & PEO, and visa processing, meaning that we can offer an individualized package of integrated back-office services in the Dominican Republic or any of the other 17 markets around Latin America and the Caribbean where we offer our services.

Contact us now for a free consultation or quote.

Or read about our team and expert authors.