Costa Rica is a key hub for business in Central America, attracting foreign companies with its political stability and skilled workforce. A Professional Employer Organization (PEO) or Employer of Record (EOR) allows you to hire employees in Costa Rica without registering a company in the country. Biz Latin Hub offers compliant, cost-effective PEO and EOR services to simplify your expansion into Costa Rica.

Key Takeaways

| Is it legal to hire through an PEO in Costa Rica? | Yes, hiring through a PEO in Costa Rica is legal. |

| What are the benefits of hiring through an PEO in Costa Rica? | Hiring through a PEO in Costa Rica offers rapid market entry without a local entity, allowing you to focus on core business operations. |

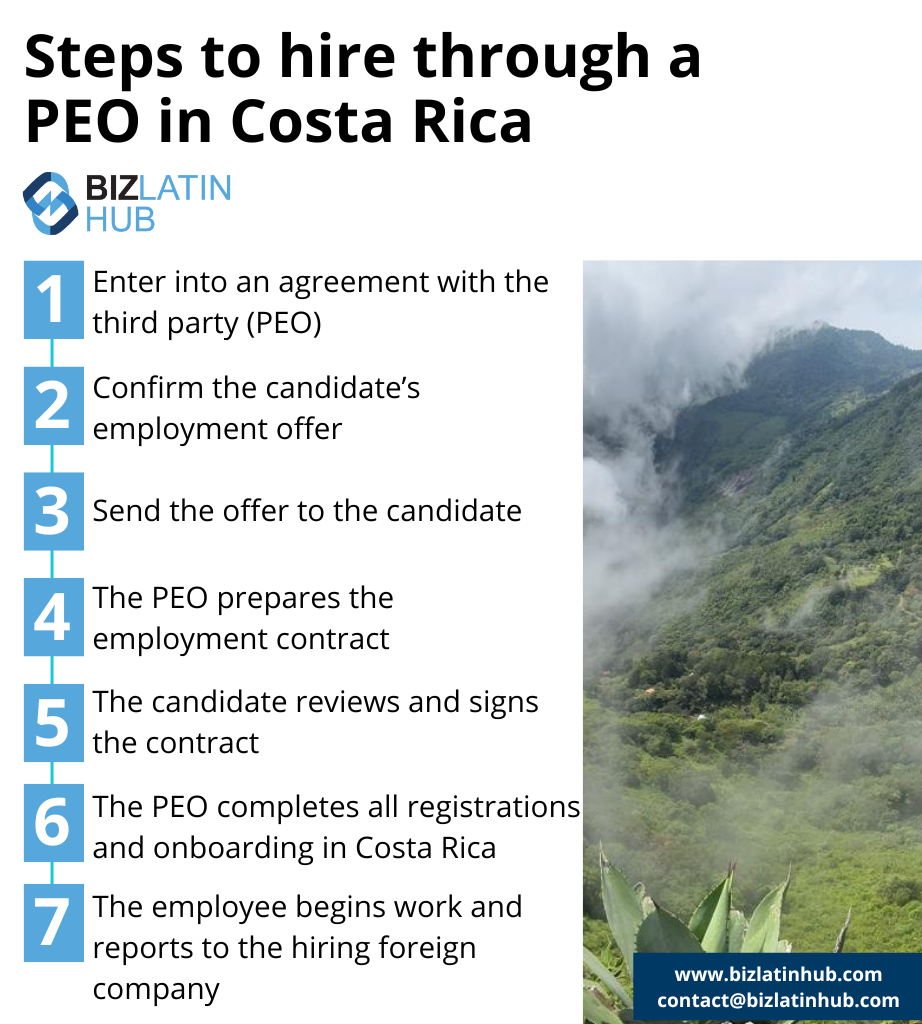

| Steps to hire through a PEO in Costa Rica | Enter into an agreement with the third party (PEO). Confirm the candidate’s employment offer. Send the offer to the candidate. The PEO prepares the employment contract. The candidate reviews and signs the contract. The PEO completes all required employee registrations and onboarding in Costa Rica. The employee begins work and reports to the hiring foreign company. |

| Why employ Costa Rican workers? | Employing Colombian workers offers access to a skilled, cost-effective workforce, strategic location for regional operations, favorable labor laws, and government incentives, while benefiting from a strong work ethic and adaptability. |

What Is a Professional Employer Organization (PEO) in Costa Rica?

A professional employer organization (PEO) in Costa Rica can handle salaries and benefits while you maintain control over tasks. Partnering with one allows your company to enter the market without company formation. This option is ideal for short-term or limited-scale operations, where you will want to avoid complex company setup and dissolution. It also accelerates operations and market understanding.

A Costa Rican PEO has a recruitment network and local job market knowledge, enabling rapid workforce acquisition based on desired profiles. Furthermore, the Professional Employer Organization in Costa Rica acts as your legal representative, ensuring compliance and providing guidance on regulatory updates. Hiring through a PEO is cost-effective compared to company formation, and facilitates swift market entry and exit.

The general responsibilities of the Costa Rican PEO include:

- Crafting and executing employment agreements.

- Managing recruitment and documentation.

- Calculating and disbursing salaries.

- Ensuring compliance with benefits and leave requirements.

Key Advantages of PEO and EOR Services for Expanding into Costa Rica

Firstly, your chosen PEO in Costa Rica will act as your legal representative, handling matters concerning the workers they hire on your behalf. Their team of corporate and employment lawyers will address any issues and represent you before local authorities if needed.

In addition, when you sign a services agreement with a Professional Employer Organization in Costa Rica, you receive the assurance of compliance with all local laws and regulations. This ensures your company maintains good standing with local authorities and avoids any fines or penalties.

Moreover, your professional employer organization in Costa Rica possesses a well-established recruitment network. This enables them to quickly find suitable staff. Their recruiters also have extensive knowledge of top local educational institutes and courses. This allows them to effectively evaluate potential candidates.

Lastly, hiring via a Professional Employer Organization in Costa Rica offers the advantage of swift market entry and exit. Once the right individuals are identified, you can commence work within days. This is especially true for entry-level positions. Likewise, exiting the market is streamlined, following the statutory notice period required by the workers.

Benefits of Using PEO & EOR Services in Costa Rica:

- Hire without opening a local company

- Full compliance with Costa Rica’s Labor Code and CCSS requirements

- Streamlined onboarding, payroll, and reporting

- Flexible market entry and exit

- Legal and HR risk mitigation

- Local team with bilingual support

How to Partner With an Professional Employer Organization in Costa Rica?

To partner with a PEO, the hiring company signs a contract with a third-party organization, designating them as the professional employer of record (EOR) for the staff members they wish to hire in Costa Rica. This designation means that, on official documentation in Costa Rica, the third-party company (the PEO/EOR) is responsible for meeting all employment regulations for the staff member.

The foreign company is therefore relieved from the burden of understanding and complying with Costa Rican employment law on its own. As a result, the foreign company faces a reduced risk of non-compliance and can focus its executives on business development and growth in the new market.

The process of hiring an employee through an employer of record is simple. Below is an outline of the steps involved when hiring an employee through a PEO in Costa Rica:

- Sign an agreement with the third party (EOR).

- Confirm the employment offer for the candidate.

- Send the employment offer to the candidate.

- Once the candidate accepts the offer, the EOR prepares the employment contract, acting as the employer of record.

- The candidate reviews and signs the employment contract.

- As the employer of record, the EOR completes all mandatory employee registrations in Costa Rica.

- The employee begins work and reports to the hiring foreign company.

What does a PEO in Costa Rica do?

The legal framework governing employers of record in Costa Rica comprises various labor laws and regulations that define the rights and obligations of employers, employees, and EORs. Understanding this framework is essential for businesses considering hiring through an EOR in Costa Rica. The key aspects of the legal framework are the following:

- Labor Code

- Employment Contracts

- Social Security Contributions

- Taxation and Payroll Compliance

- Employment Termination

- Health and Safety

Each of these aspects, and how they relate to EORs or PEOs in Costa Rica, will be discussed below.

- Labor Code: The Labor Code of Costa Rica regulates labor relations in the country. It outlines the rights and obligations of employers and employees, covering aspects such as working hours, minimum wage, social security, and termination of employment contracts. EORs must comply with the provisions outlined in the Labor Code to protect workers’ rights.

- Employment Contracts: Employment contracts in Costa Rica can be written or verbal. However, it is advisable to have written contracts that specify crucial details such as job description, working hours, compensation, benefits, and duration of employment. EORs play a vital role in ensuring that employment contracts comply with the requirements of the Labor Code and other relevant regulations.

- Social Security Contributions: EORs in Costa Rica must contribute to the social security system on behalf of their employees. These contributions cover health insurance, retirement benefits, and other social programs. The Employer of Record is responsible for managing and ensuring the accurate calculation and payment of these social security contributions on behalf of the employer and the employees.

- Taxation and Payroll Compliance: The Costa Rican tax authorities require EORs to comply with their regulations. They are responsible for calculating and deducting the appropriate income tax and social security contributions from employee salaries. EORs also ensure the accurate filing and payment of these taxes to the tax authorities, relieving the hiring organization of the administrative burden associated with payroll compliance.

- Employment Termination: The Labor Code establishes the grounds and procedures for terminating employment contracts in Costa Rica. To avoid legal disputes EORs should follow legal requirements when terminating an employee’s contract. Under the Labor Code, termination can be based on mutual agreement, expiration of the employment contract, disciplinary issues, or economic reasons.

- Work Permits and Immigration: If hiring foreign employees through an EOR, it is necessary to comply with the immigration laws and regulations of Costa Rica. EORs assist in obtaining the required work permits and visas for foreign employees, ensuring compliance with immigration requirements.

- Health and Safety: Employers, including EORs, are responsible for providing a safe and healthy work environment. They must comply with Occupational Health and Safety regulations, including implementing safety measures, conducting necessary training, and ensuring compliance with workplace health and safety standards.

Businesses need to work with an Employer of Record that understands Costa Rica’s employment laws. A good EORs ensures compliance with labor laws, taxation, and other regulatory requirements, minimizing the risk of legal issues and ensuring a smooth employment process for employers and employees.

PEO vs. EOR: Which Is Right for Your Business?

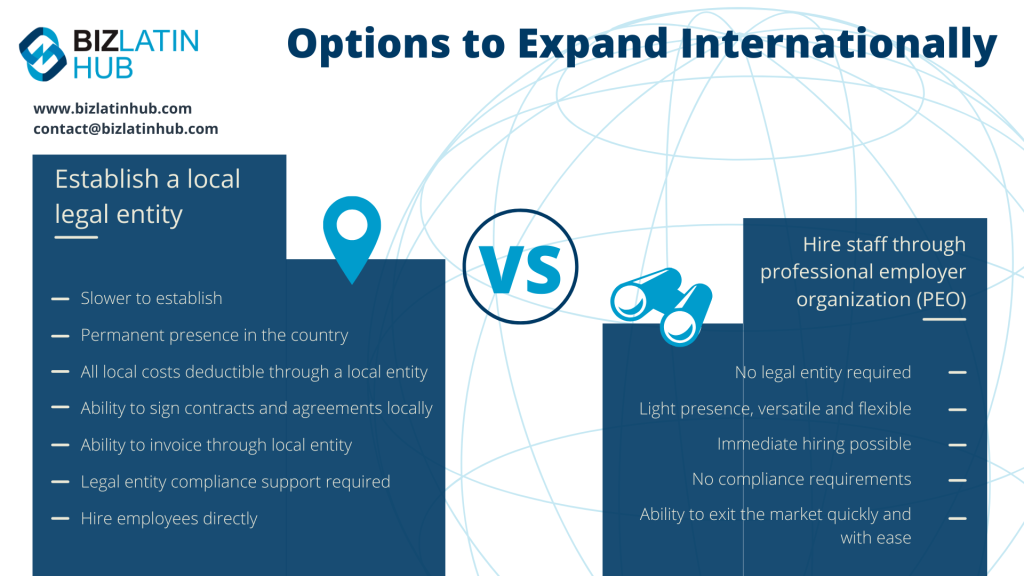

When expanding into Costa Rica, businesses often choose between an Employer of Record (EOR) or a Professional Employer Organization (PEO) to hire and manage employees.

- EOR (Employer of Record): A third-party provider that legally hires employees for companies, handling payroll, taxes, and compliance. It enables quick market entry without a local entity but may have limitations for long-term operations. EOR services are legal in Costa Rica.

- PEO (Professional Employer Organization): A service provider that supports companies with a local entity establishment and then managing payroll, benefits, and HR compliance. While entity setup requires initial time and investment, it offers greater stability, talent attraction, ability to build a long company culture and reduced permanent establishment risks.

Note that EOR and PEO are often used interchangeably and, in some cases, may even mean the same thing, as their meanings can vary depending on context, local legal frameworks, and business local norms. In Costa Rica, both services are legally recognized and commonly utilized by foreign businesses.

Important Tip: While an EOR provides a quick-entry solution, establishing a legal entity and working with a PEO typically offers greater control, long-term cost efficiency, reduced permanent establishment risk, stronger legal standing, and better talent attraction in Costa Rica. Biz Latin Hub offers both EOR and PEO solutions, helping businesses navigate Costa Rican regulations, establish entities, and ensure full HR compliance. Whether you need a fast market entry or a stable long-term presence in this stable Central American economy, we can guide you through the process.

PEO vs. EOR: Which Is Right for Your Business?

| Feature | PEO Costa Rica | EOR Costa Rica |

|---|---|---|

| Legal Employer | Client (entity required) | Biz Latin Hub (acts as employer) |

| Hiring Speed | Moderate | Fast |

| Compliance Responsibility | Shared | Fully handled by EOR |

| Best For | Companies with a presence in Costa Rica | Fast market testing and scaling |

| Contract Ownership | Company-employee | EOR-employee |

Choose the structure that best fits your company’s entry or growth strategy in Costa Rica.

How to Use a Payroll Calculator

If you want to get an idea of the possible costs involved in outsourcing to Costa Rica, using a payroll calculator is one way to get a good estimate.

Although a payroll calculator won’t be completely accurate, it will give you the opportunity to evaluate options while varying the salary, the number of employees, the country you want to enter, and the currency you wish to work in. As such, you will be able to understand your likely costs across a range of salaries, while also being able to compare other countries as potential alternative destinations.

You can find the BLH payroll calculator at the bottom of our Hiring & PEO Services page. The calculator will allow you to make good estimations of the costs involved in hiring in Latin America and the Caribbean based on country, currency, and salary, with the calculator factoring in local statutory deductions.

To use the BLH payroll calculator, you will need to undertake the following steps:

Step 1: Select the country

Choose the country where you are doing business, or planning to launch. This feature will be useful when it comes to comparing potential alternative markets.

Step 2: Select the currency you wish to deal in

You can choose between US dollars (USD), British Sterling (GBP) and Euros, as well as the local currency for the country you are looking at, in comparison to what is most convenient to you. Note that for Ecuador, El Salvador, and Panama, the local currency is also USD, as they have dollarized economies.

Step 3: Indicate an employees monthly income

Here you can indicate the expected salary you will be paying an employee, in the currency of your choice.

Step 4: Calculate your estimated costs

Based on all of the information you have provided, you will receive results indicating your estimated costs, including a breakdown for estimated statutory benefits you will be liable for.

Step 5: Compare your costs to other options

With a good estimate at hand of how much your staff in Costa Rica would cost, if you are flexible about your expansion into Latin America and the Caribbean, you can use the BLH payroll calculator to compare those costs to other jurisdictions.

Why is Costa Rica a good place to do business?

Costa Rica is renowned for being one of the most stable and prosperous nations in Latin America, boasting impressively low rates of violent crime within the region.

This remarkable was achieved following nearly four decades of consistent growth, with the gross domestic product (GDP) experiencing only a single annual decline between 1981 and 2019, and ultimately, reaching $61.8 billion by the end of this period. Costa Rica’s robust growth, political stability, and low crime rates have made it an attractive destination for expatriates, tourists, and foreign investors alike. Nowadays, the country registers more than $3.9 billion of foreign direct investment (FDI). This has made a PEO in Costa Rica more attractive.

The nation boasts a thriving technology sector, a well-established professional services industry, and highly-developed tourism and agriculture sectors. It also possesses a strong manufacturing base. Costa Rica produces critical exports such as pharmaceuticals, electrical machinery, and medical equipment.

Costa Rica has taken significant steps to boost its competitiveness by introducing new incentives to attract foreign direct investment across the country, particularly in emerging regions. This includes signing nine government decrees that focus on strengthening territorial competitiveness and streamlining administrative processes. The new regulations have made it even easier to use a PEO in Costa Rica.

The new laws introduce no less than eleven incentives aimed at promoting territorial development in sectors such as agroindustry, food industry, light manufacturing, tourism infrastructure, and services. These measures aim to stimulate investment and create employment opportunities in regions outside the Greater Metropolitan Area, where nearly half of the country’s population resides.

FAQs on Hiring Through an EOR or PEO in Costa Rica

Based on our extensive experience, these are the common questions and doubts of our clients on on hiring through an EOR in Costa Rica:

1. How does one hire employees in Costa Rica?

You can hire an employee by incorporating your own legal entity in Costa Rica, and then using your own entity to hire employees or you can hire through an Employer of Record (EOR), which is a third party organization that allows you to hire employees in Costa Rica by acting as the legal employer. With an EOR you do not need a Costa Rican legal entity to hire local employees.

2. What is in a standard employment contract in Costa Rica?

A standard Costa Rican employment contract should be written in Spanish (and can also be in English) and must contain the following information:

- ID and address of the employer and employee.

- City and date.

- The location where the service will be provided.

- Type of tasks to be carried out.

- Remuneration and bonifications/commissions (if applicable).

- Method payment frequency.

- Duration of the contract.

- Probation period.

- Work hours.

- Additional benefits (if applicable).

3. What are the mandatory employment benefits in Costa Rica?

The mandatory employment benefits in Costa Rica are the following

- Working tools necessary to carry out the work (if applicable)

- Payment of social security contributions (health, pension, and labor risks).

- Social benefits (severance pay, Christmas bonus, maternity, or paternity leave).

- Paid time off (vacation and a day off).

- Transportation allowance (if applicable)

- Overtime and surcharges (if applicable)

For more information on mandatory employment benefits read our recent article on Employment laws in Costa Rica

4. What is the total cost for an employer to hire an employee in Costa Rica?

The total cost for an employer to hire an employee in Costa Rica can vary based on the salary. However, the employer cost for mandatory employment benefits is approximately 26.3% over the employee’s salary, which is additional to the employee’s gross salary.

Please use our Payroll Calculator to calculate employment costs.

5. What is the difference between hiring through an EOR and forming a legal entity?

Forming a legal entity is different to hiring an EOR in the following ways:

- Slower to establish.

- Permanent presence in the country.

- All costs deductible through a local entity.

- Ability to sign contracts and agreements locally.

- Ability to invoice through local entity.

- Legal entity compliance support required.

- Hire employees directly.

6. What is the difference between a PEO and an EOR in Costa Rica?

A PEO acts as co-employer and an EOR acts as the legal employer of your employees. An EOR can offer broader services than a PEO.

7. What is a PEO in Costa Rica?

A PEO provides employment support for companies with a local legal entity and shares HR responsibilities.

8. What is an EOR in Costa Rica?

An EOR legally employs your workers and ensures full compliance with labor and social security laws, even without a Costa Rican entity.

9. Can I move from EOR to my own entity later?

Yes, Biz Latin Hub supports both transitions and company formations.

10. Are PEO and EOR services legal in Costa Rica?

Yes, and they are fully compliant with Costa Rica’s Ministry of Labor, CCSS (social security), and INS (insurance).

Biz Latin Hub offers hiring & PEO services in Costa Rica

At Biz Latin Hub, our team of multilingual hiring and PEO experts in Costa Rica has vast experience in sourcing, recruiting, and handling payroll for qualified personnel on behalf of foreign investors. We offer a comprehensive range of back-office solutions, such as legal, accounting, commercial representation, and company formation services.

With our expertise, we can serve as your sole point of contact to oversee your market entry and ongoing operations in Costa Rica. Additionally, we have a presence in 17 other countries across Latin America and the Caribbean, providing our services in those markets too.

Reach out to us now for a consultation or free quote. Or learn more about our team and expert authors.