To register a company in Costa Rica, you must follow several straightforward steps in order to take advantages of the opportunities the country provides. With the right guidance, the incorporation process in Costa Rica is streamlined and ensures compliance with the country’s clear rules and regulations. This includes registering with the National Registry (Registro Nacional) as part of company formation in Costa Rica.

Your ongoing tax compliance will require registration with the Ministry of Finance (Ministerio de Hacienda) as well. Biz Latin Hub provides unmatched local expertise and a full range of back-office services, allowing you to focus on growing your business and making Costa Rica an integral part of your success.

Key Takeaways On How To Register a Company in Costa Rica

| Is Foreign Ownership Permitted in Costa Rica? | This is permitted in Costa Rica, including 100% ownership. You will need local representatives. |

| Steps to Register A Company in Costa Rica: | Step 1 – Pay agency fees when forming your Costa Rican company. Step 2 – Choose the company structure. Step 3 – Search for homonyms of the company name. Step 4 – Sign off on proper documentation. Step 5 – Register an incorporation charter. Step 6 – Open a corporate bank account in Costa Rica. Step 7 – Register as a taxpayer in Costa Rica. Step 8 – Apply for insurance. Step 9 – Register with Costa Rican Social Security. Step 10 – Receive your Costa Rica Company Kit. |

| What Are The Common Entity Types in Costa Rica? | – Corporation/Joint Stock Companies (Sociedad Anónima – S.A). – Limited Liability Company (Sociedad de Responsabilidad Limitada – S.R.L). – Branches of foreign companies. |

| Why Set-up a Business in Costa Rica? | Costa Rica is proactively supporting its thriving industries, including technology, tourism, agriculture, manufacturing, and renewable energy |

10 Simple Steps to Register a Company in Costa Rica

Registering a company in Costa Rica is easy compared to many other countries. You can handle it remotely with the help of a Power of Attorney and an incorporation agent.

- Step 1 – Pay agency fees when forming your Costa Rican company.

- Step 2 – Choose the company structure.

- Step 3 – Search for homonyms of the company name.

- Step 4 – Sign off on proper documentation.

- Step 5 – Register an incorporation charter.

- Step 6 – Open a corporate bank account in Costa Rica.

- Step 7 – Register as a taxpayer in Costa Rica.

- Step 8 – Apply for insurance.

- Step 9 – Register with Costa Rican Social Security.

- Step 10 – Receive your Costa Rica Company Kit.

1. Pay agency fees when forming your Costa Rican company

If you’re using a firm to help you with the incorporation process, the firm may ask for upfront payment on services to obtain the necessary due diligence documents.

2. Choose the company structure

You need to choose the right company structure for your company’s needs and activities. Following this, you’ll need a project plan draft detailing the timeline and tasks for each week of the incorporation process.

3. Check for homonyms of the company name

A firm will help check for homonyms of your proposed company name and file an application to reserve your company name with the Costa Rica Registrar of Companies.

4. Sign off on proper documentation

The agency will ask you to sign, notarize, and legalize documents from your country of residence. You’ll then return them to the agency for timely documentation registration in Costa Rica.

5. Register an incorporation charter

A company incorporation charter, also called an M&AA, is filed at the mercantile section of the public registry in Costa Rica. The firm can then legalize the company’s bookkeeping.

6. Open a corporate bank account in Costa Rica

Once you’ve successfully incorporated your company, the law firm will open a corporate bank account for the company and deposit the capital to start the business. Additionally, depending on the firm, they might pay incorporation fees to the bank on behalf of your company.

7. Register as a taxpayer in Costa Rica

The agency files a D-140 form to the government to register your company as a legal taxpayer in Costa Rica. The company may let you use their office address for tax purposes until you get an office address in the country for your company.

8. Apply for insurance

After your company hires staff in Costa Rica, the company will be registered for labor risk insurance with the National Insurance Institute.

9. Register with Costa Rican Social Security

Post-incorporation, the firm will register your company as an employer with the Caja Costarricense de Seguro Social (CCSS).

10. Receive your Costa Rica Company Kit

Ideally, your contracted firm will send you all of the documentation for your company that has been filed throughout the incorporation process.

The incorporation process in Costa Rica generally takes 4 to 6 weeks, depending on document preparation, translations, and how quickly the National Registry processes the submission.

What Information Do You Need to Get Started With Company Formation in Costa Rica?

To proceed with incorporating an SRL in Costa Rica, you will need to provide the following:

- A name for your legal entity.

- Shareholder (s) identification document.

- Confirm the business activities, corporate purpose, and primary operations.

- Minimum initial capital to be registered.

Important Tip: We always recommend having a preferred legal name and two alternatives in case the primary legal name is unavailable.

Types of Legal Entities Available in Costa Rica

Before starting a company in Costa Rica, it’s important that you understand the most common structures. The three most common legal entities in Costa Rica are:

- Corporation/Joint Stock Companies (Sociedad Anónima – S.A).

- Limited Liability Company (Sociedad de Responsabilidad Limitada – S.R.L).

- Branches of foreign companies.

Corporation/Joint Stock Companies (Sociedad Anónima – S.A)

The S.A. is the most common legal entity structure in Costa Rica. Some of its key characteristics:

- A public document must be drafted with the bylaws and signed by the Public Notary and company shareholders.

- A minimum of (2) shareholders are required.

- There is no established minimum capital.

- A board must be appointed, consisting of three board members and a controlling agent.

The availability of the company name needs to be checked with the National Registry Database.

Branches of Foreign Companies

Branches of foreign companies are incorporated with a public deed signed by the Public Notary and the power of attorney of the foreign company. Due to the complexities of drafting and signing all the agreements, this legal structure is not recommended for SMEs. It is also considered more expensive than other legal entities in Costa Rica.

Limited Liability Company (Sociedad de Responsabilidad Limitada – S.R.L)

The Limited Liability Company has the same requirements as the S.A., with the only exception being the administration; shareholders are required to appoint at least one General Manager. Shares are called quotas and there is no minimum required capital. However, the amount subscribed must be divisible by 100.

It’s essential to verify the availability of the company name on the National Registry database. This is our recommendation for foreign investors, due to its administrative flexibility.

Comparison of S.R.L. and S.A. Business Entities

| Aspect | S.R.L. | S.A. |

|---|---|---|

| Shareholders | A minimum of 2 | At least two shareholders, three board members, and a comptroller who is not part of the board. |

| Administration | No board of directors, only appointed administrators. | A board with at least three members. |

| Liability | Shareholders are jointly liable for debts up to their contributions. | Shareholders are jointly liable for debts up to their contributions. |

| Transfer of Shares | Require approval from other shareholders. | Can be transferred through endorsement without approval. |

| Company Size | Ideal for smaller companies or those with shareholders outside Costa Rica. | Better for larger companies. |

| Regulatory Requirements | Fewer formalization requirements. | More stringent regulatory requirements |

Legal Requirements to Register a Company in Costa Rica

The minimum requirements to incorporate a company in Costa Rica are the following:

- A name for the new legal entity to be formed.

- A minimum of (2) shareholders, which can be either natural (i.e. persons) or legal persons (i.e. entities).

- Appoint a resident director (and where this person is a foreign national, there is a need to also appoint a resident agent, who is a locally educated and certified lawyer).

- Confirm business activities and corporate purpose.

- A minimum capital of USD$400, needs to be transferred upon bank account opening.

- Register a Fiscal Address which must be within the country and is used for official correspondence.

Important Tip(s):

Although the minimum capital is USD 400, we always recommend a minimum capital of USD$1,000, which should be commensurate with the planned business activities of the company.

The founding shareholders do not need to physically travel to the country as the establishment can be completed via a power of attorney signed via DocuSign.

The legal representative must be a Costa Rican resident, although does not have to be a national

Although you must maintain a correspondence address in Costa Rica, you are free to operate a virtual office if you wish.

Minimum capital requirements and bank account opening in Costa Rica

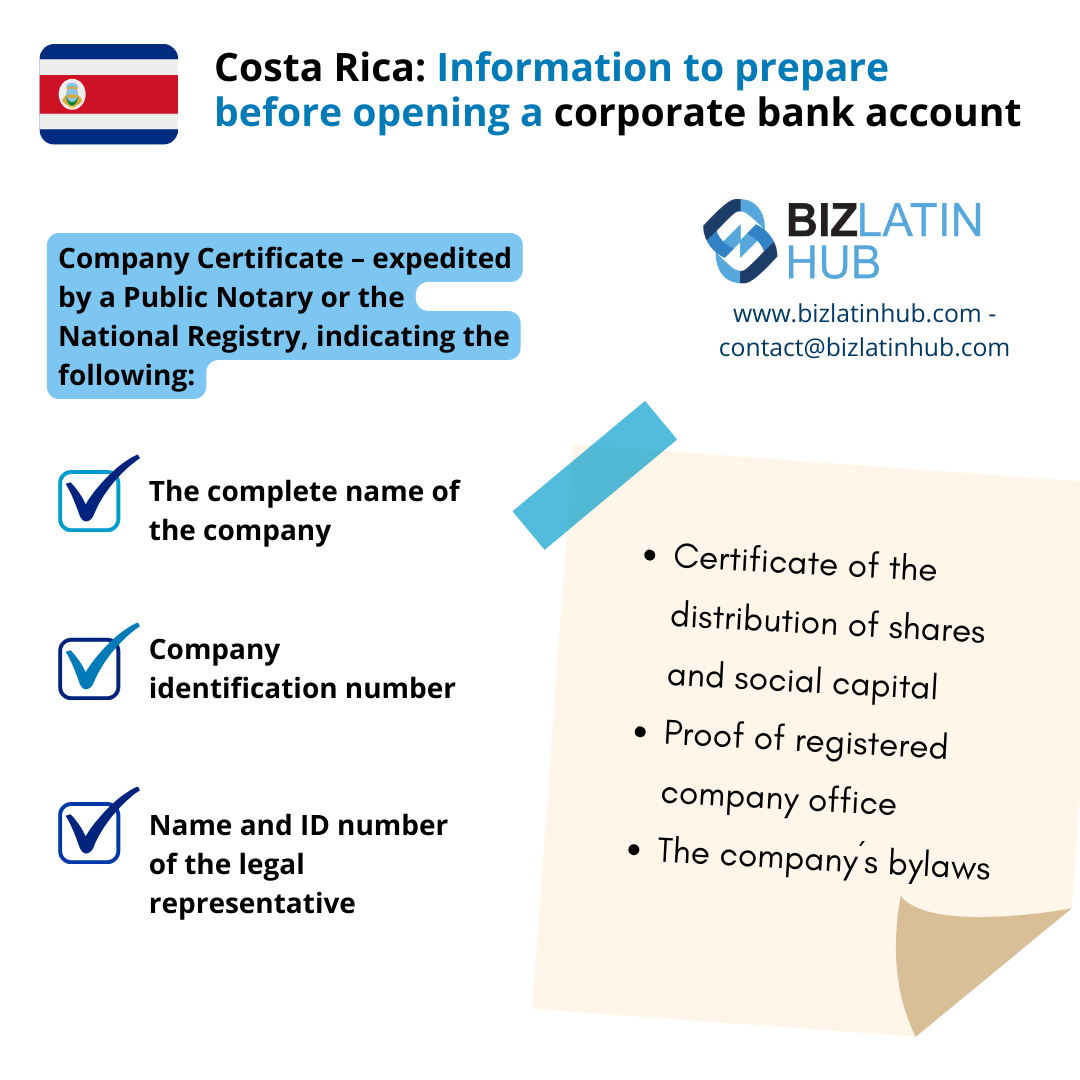

Different banks in Costa Rica may request different documents from customers seeking to open a corporate bank account. These documents may be of a legal or financial nature and should be in Spanish. Other types may also be required. A minimum capital requirement is not in place for an SRL, however some banks may request a minimum starting deposit in the account. Be aware that you generally have to arrive in-person for bank onboarding.

Generally, most local banks will request the following information:

- Company certificate – expedited by a public notary or the National Registry, indicating the following:

- The complete name of the company.

- Company identification number.

- Name and ID number of the legal representative.

- Certificate of the distribution of shares and social capital.

- Proof of registered company office.

- The company’s bylaws.

Costa Rica Tax Compliance Overview

Costa Rican accounting standards require companies to prepare their financial statements, accounting registries and books of account in Spanish and in accordance to International Financial Reporting Standards. You must also keep the accounting and legal books updated and make sure that all information regarding the company is up to date with the Ministry of Finance.

Other obligations are to complete the registry of transparency and final beneficiaries, which allows legal entities to provide the information to register their participants, presentation of VAT tax declarations each month and annual presentation of income tax returns.

Companies that do not declare activity declare income at zero or less than 120 base salaries, approximately $102,800. They pay 25% of the base salary (approx. USD$214). Companies with gross income between 120 and 280 base salaries pay 30% of the base salary (approx. USD$257).

Companies with gross income of more than 280 base salaries pay 50% of the base salary (approx. USD$428). Newly created companies pay the same amount as ‘non-taxpayer’ companies, the payment is made proportionally to the date of company formation and the rest of the year.

- Corporate income tax: 5–30%

- VAT: 13%

- Monthly and annual declarations

- Registration with Ministry of Finance

- CCSS (Caja) for employee social contributions

FAQs About Company Formation in Costa Rica

Based on our experience, these are the typical questions and areas of uncertainty for our clients.

1: What is the process to incorporate a company in Costa Rica?

Incorporating a company in Costa Rica involves selecting a legal entity (commonly an S.A. or SRL), drafting and notarizing the articles of incorporation, registering with the National Registry (Registro Nacional), obtaining a corporate tax ID from the Ministry of Finance (Ministerio de Hacienda), and enrolling in social security if employing staff.

2: What types of companies can foreign investors register in Costa Rica?

The two most common legal structures are the Sociedad Anónima (S.A.) and the Sociedad de Responsabilidad Limitada (SRL). SRLs are typically preferred for small and medium-sized businesses due to easier administration and limited liability protections.

3: How long does it take to register a company in Costa Rica?

The incorporation process in Costa Rica generally takes 4 to 6 weeks, depending on document preparation, translations, and how quickly the National Registry processes the submission.

4: What are the requirements to start a business in Costa Rica?

Requirements include at least two shareholders (for an S.A.), a Costa Rican legal representative, a registered fiscal address, notarized company bylaws, and enrollment with tax and social security authorities. Foreign shareholders must provide identification and apostilled documents.

5: What are the tax obligations for companies in Costa Rica?

Corporate tax rates vary based on income (from 5% to 30%), and businesses must file annual returns. VAT is 13%, and companies must register with the Ministry of Finance, submit monthly declarations, and withhold/pay social security contributions for employees.

Benefits of Incorporating in Costa Rica

There are many reasons to expand in the country. Foreign investors who incorporate a company in Costa Rica’s economy might choose to operate in several thriving industries, including technology, tourism, agriculture, manufacturing, and renewable energy.

Sustainable and green innovation is one of the key reasons to register a company in Costa Rica. Successful examples of green tech include Dosmil50, while the eco-tourism industry alone contributes almost USD$1.5 billion a year to the economy. Costa Rica is undoubtedly a world leader in this area.

As a result, Foreign Direct Investment (FDI) has surged in the past decade, reaching over $3 billion in 2023. It has solid Free Trade Agreements (FTAs) with Chile, Panama, and Mexico, and is a key member of the Central American Common Market (CACM) with El Salvador, Guatemala, Honduras, and Nicaragua. If you’re considering doing business in Costa Rica, read on to understand how to register a company in Costa Rica in 10 steps.

Register your company in Costa Rica with the help of Biz Latin Hub

Forming a company in Costa Rica can be challenging. Using an incorporation firm to aid you in starting your business can save you time, stress, and money in the long run when you register a company in Costa Rica.

At Biz Latin Hub, our multilingual team has the expertise and experience to help you with any of your projects. We offer comprehensive legal, recruitment, and tax advisory services to support your business success in the Central American nation and the 15 other countries in Latin America and the Caribbean where we operate.

Get in touch with us today for personalized advice and support.

Learn more about our team and expert authors.